Inventory items can break, spoil, expire or be stolen, or you can receive additional stock, such as a free shipment. For this reason, you may need to change your inventory records to match the actual quantities.

Inventory adjustments can be used to correct the in-stock figure for a product. This may be used to correct the quantity of an item after a stock take or to write off some of the items.

Inventory adjustments should not be used to add purchased inventory or remove sold inventory – in such cases inventory should always be received into stock against a purchase document (or an incoming shipment document) and removed from stock by a sales invoice (or an outgoing shipment document).

Go to Warehouse -> Documents and then open “Inventory Adjustments” tab to review the list of the adjustments made. To make a new inventory adjustment, press the “Create a New Inventory Adjustment” button

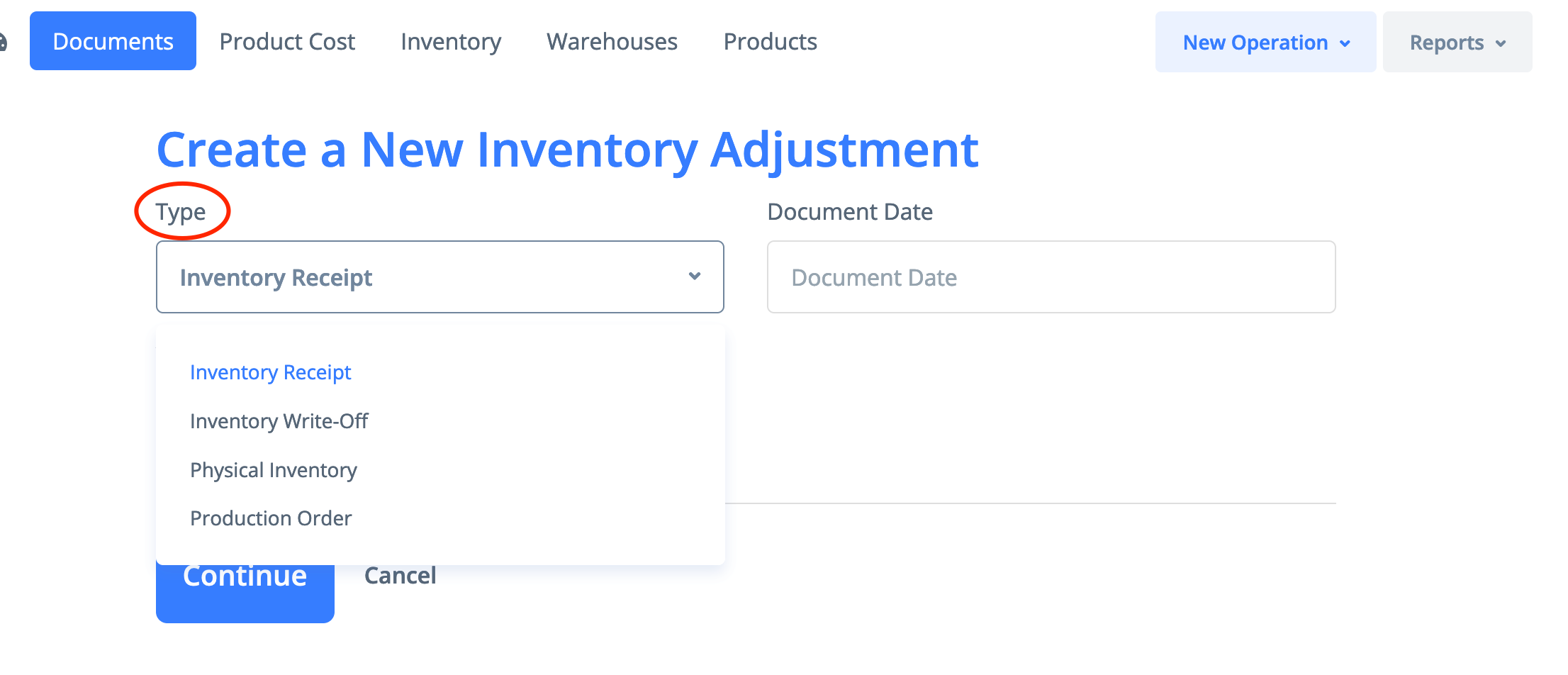

In the form that opens, select the date of the operation, the warehouse to which it applies and the type of adjustment.

The current inventory can be adjusted by using the following adjustment types:

1) Inventory Receipt – an operation to increase the current inventory balance.

2) Inventory Write-off – an operation to reduce the current inventory balance.

3) Physical Inventory — available stock (as stated in the program) and physical stock reconciliation and the adjustment of the discrepancies revealed. More information can be found here.

4) Production Order – the production of an item (and the receipt of the goods to the warehouse associated with it) from another item/items (and the withdrawal of the goods from the warehouse associated with it), conducted at the same warehouse. More information can be found here.

When items are added to or removed from the inventory, an accounting journal is automatically created in order to adjust the asset value of the inventory. The entry type depends on the selected inventory accounting method (system of inventory) – periodic or perpetual.

Each in-stock item has an asset value associated directly with it. Therefore, when removing an item from stock, the actual value (taken from the last calculated cost price) of the specific item removed will be used (this value can be manually edited during the process of adding the item).

Similarly, when adding items into stock, the actual cost (taken from the last calculated cost price) of the specific item will be used (this value can be manually edited during the process of adding the item).