Two systems of inventory are generally used for keeping records of inventory.

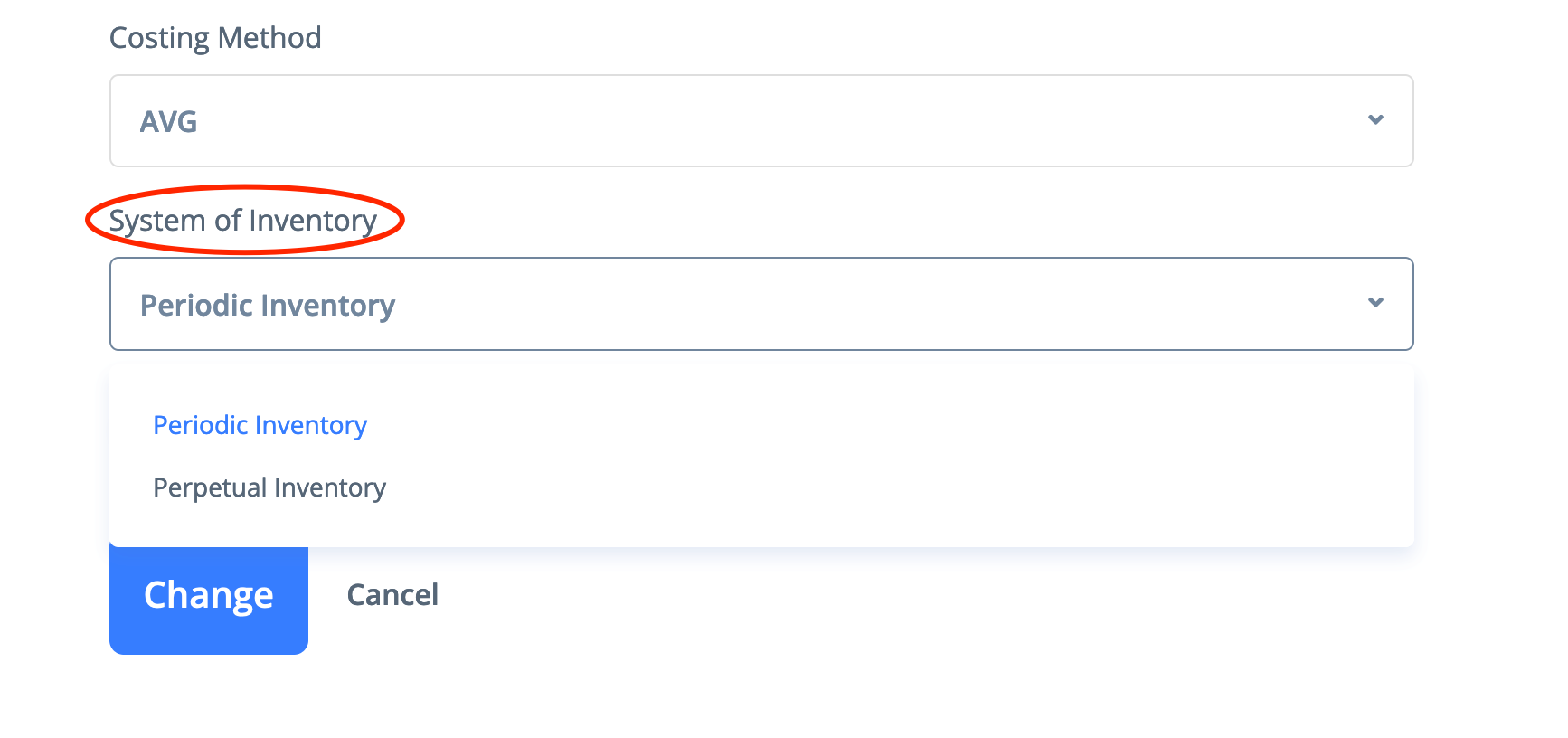

To change the system of inventory go to the Settings -> Company Profile -> General Info

Periodic Inventory

Periodic inventory management allows a company to know its beginning inventory and ending inventory within an accounting period, but it does not track inventory on a daily basis. Inventory is tracked by a physical inventory count. Under this system, all purchases are recorded as an expense in the purchases account, with no cost posting made at the moment of the sale. When in the end of the period physical inventory is done, the balance in the purchases account is shifted into the inventory account, which in turn is adjusted to match the value of the ending inventory only after the actual cost is calculated.

Perpetual Inventory

In contrast, the perpetual inventory system keeps track of inventory balances continuously, and all purchases are recorded in the inventory account right away. At the moment of the sale there is a record of the value of the products sold (by standard cost) which is written off from the inventory account to the cost of goods sold account.

When the perpetual system is used, inventory value is displayed continuously and updated in the balance sheet after each new operation.

Standard cost is a projected cost of the product used in sales to write off the inventory value (under the perpetual (continuous) inventory system). Then, when the actual cost of the product is calculated, the cost of goods sold account is adjusted according to the difference between the actual cost and the standard one.

Standard cost can be set for every product manually or calculated automatically when the actual cost is calculated for the first time for the goods with not yet standard cost specified. When subsequent calculations of the actual cost are made, you can update, if needed, the standard cost of products by selecting those of them which standard cost deviation from the actual cost is higher than the specified percentage.