Foreign exchange gains or losses occur when a company purchases and/or sells goods and services in a foreign currency and that currency fluctuates against its home currency. This may result in differences in the value of monetary assets and liabilities that must be recognized periodically until they are completely settled.

Realized and unrealized gains or losses from foreign currency transactions differ depending on whether or not the transaction has been completed by the end of the accounting period.

Realized gains or losses refer to profits or losses from completed transactions. For example, you issued invoice to a customer on one day (at one exchange rate), and the customer paid it on another day (when a different exchange rate is actual), you will faces with realized currency gains or losses.

The gains or losses from these transactions are calculated in PayTraq automatically and will appear in corresponding payment journal entries (on general ledger account – Exchange rate realized gains/losses).

Unrealized gains or losses refer to profits or losses that can be calculated, but the relevant transactions have not been completed. In other words an unrealized gain or loss is a potential gain or loss at any point in time between the recorded sale or purchase and the receipt or release of payment.

For example, you issued invoice to a customer, and this invoice is still waiting for payment. In this case, if the exchange rate on the day the invoice was written is different from the exchange rate for today – you have unrealized currency gain or loss from this invoice. Of course this gain or loss is just "on paper". No automatic postings are made to track unrealized gains or losses on foreign currency transactions.

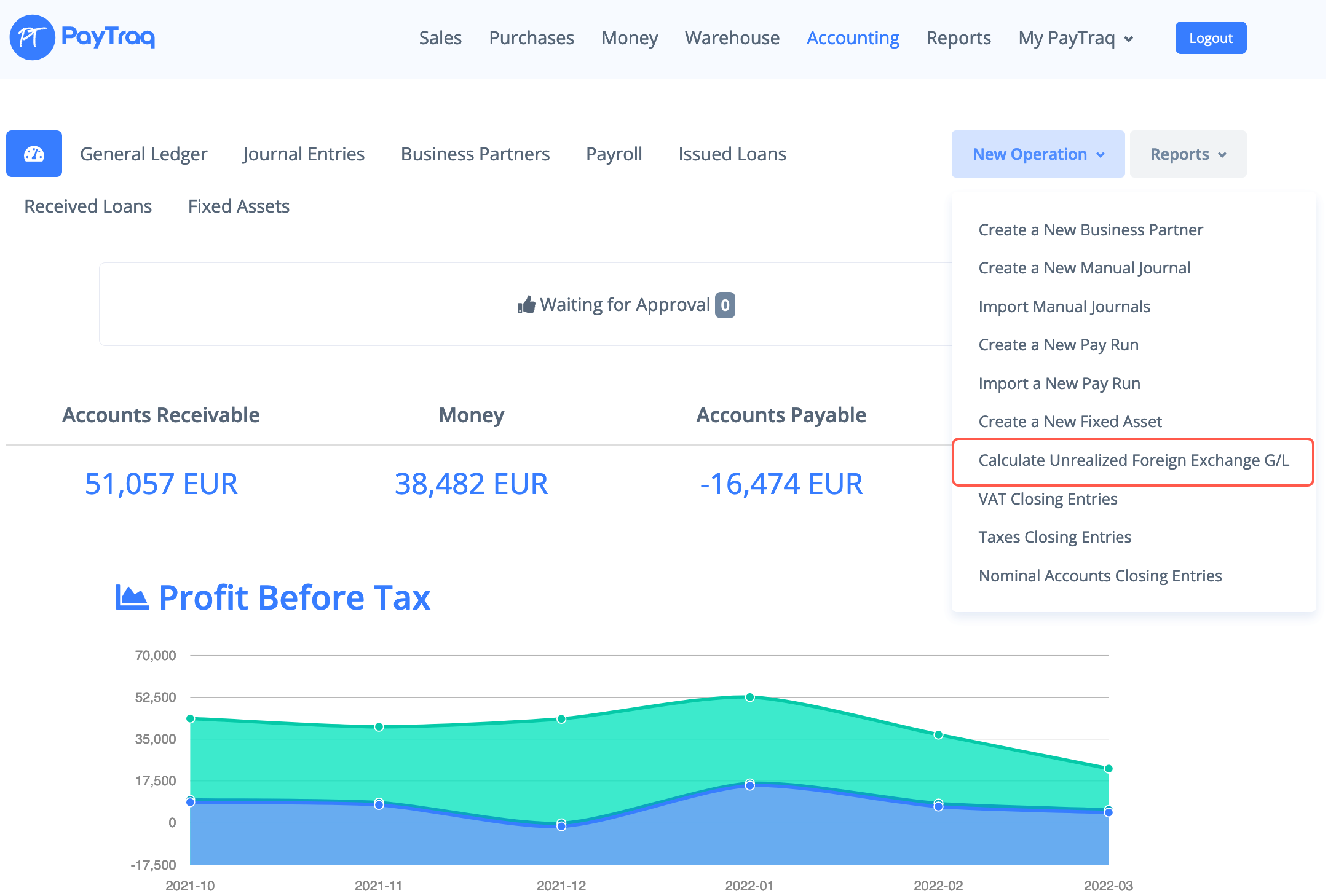

To calculate unrealized currency gains and losses for all assets and liabilities nominated in foreign currency (issued and received unpaid invoices, open loans, etc.) go to Accounting -> New Operation -> Calculate Unrealized Foreign Exchange Gains and Losses

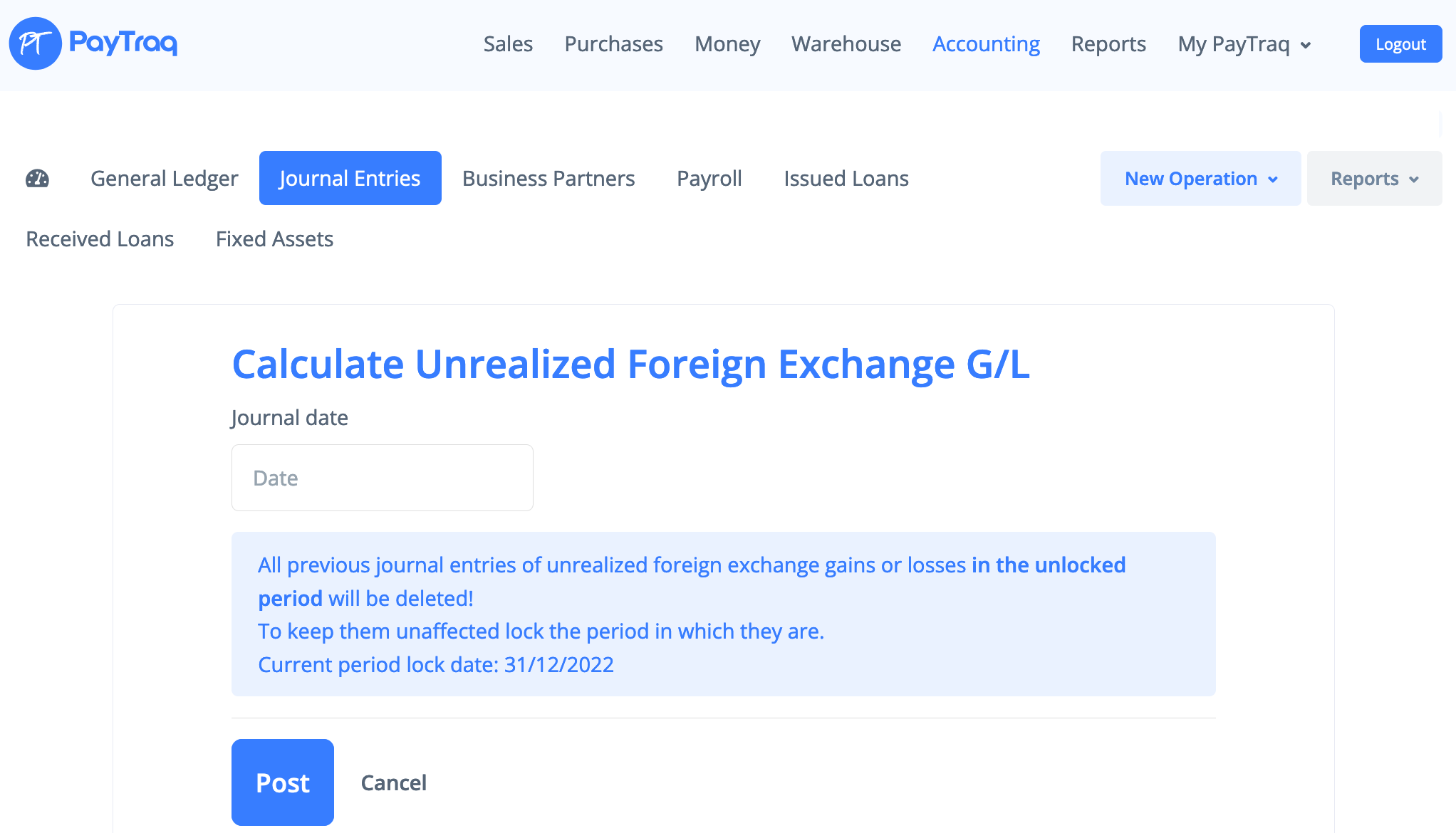

In the window that opens, choose the calculation date and click ''Post'' button.

Please keep in mind that all previous journal entries of unrealized foreign exchange gains or losses in the unlocked period will be deleted!

To keep them unaffected lock the period in which they are.

For example, if at the end of the previous accounting year you made a calculation of unrealized foreign exchange gains and losses, then you need to lock the previous year to keep this entry intact.