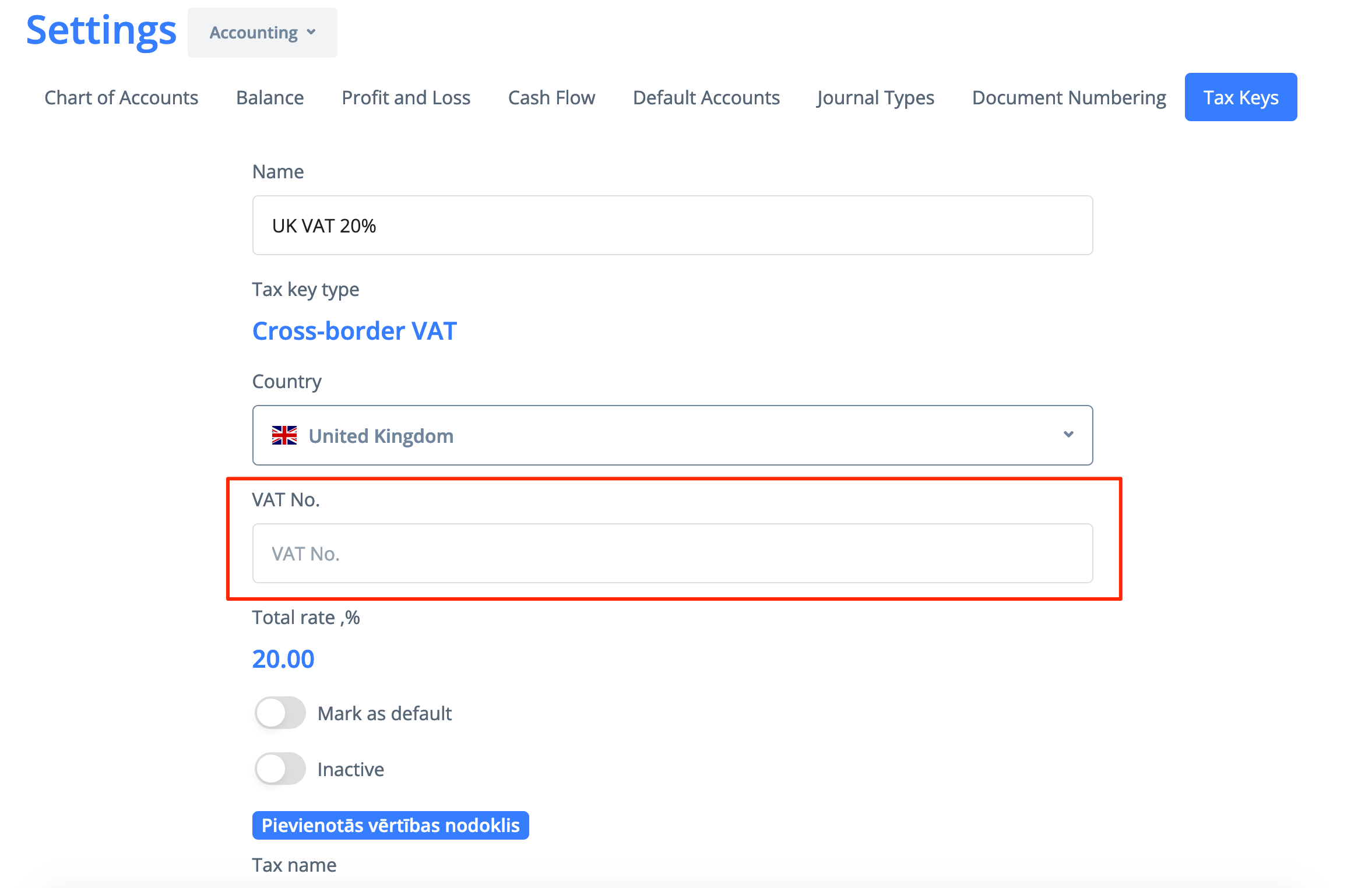

A separate VAT number can be defined for VAT One Stop Shop and Cross-border VAT tax key types. In these cases the default VAT number will be replaced for any invoices where such tax keys are applied.

If you are operating under VAT OSS scheme then VAT One Stop Shop tax keys should be used. More information about VAT OSS scheme can be found here.

Cross-border VAT

Cross-border tax keys can be used to separate the operations in different tax zone from the local tax reports.

You can create a new tax key with the "Cross-border VAT" type. This can be done from My PayTraq -> Settings -> Accounting -> Tax Keys

After that you can apply this tax key to any operation in the the foreign tax zone. For instance the tax key can be assigned to a customer so it could be selected automatically.

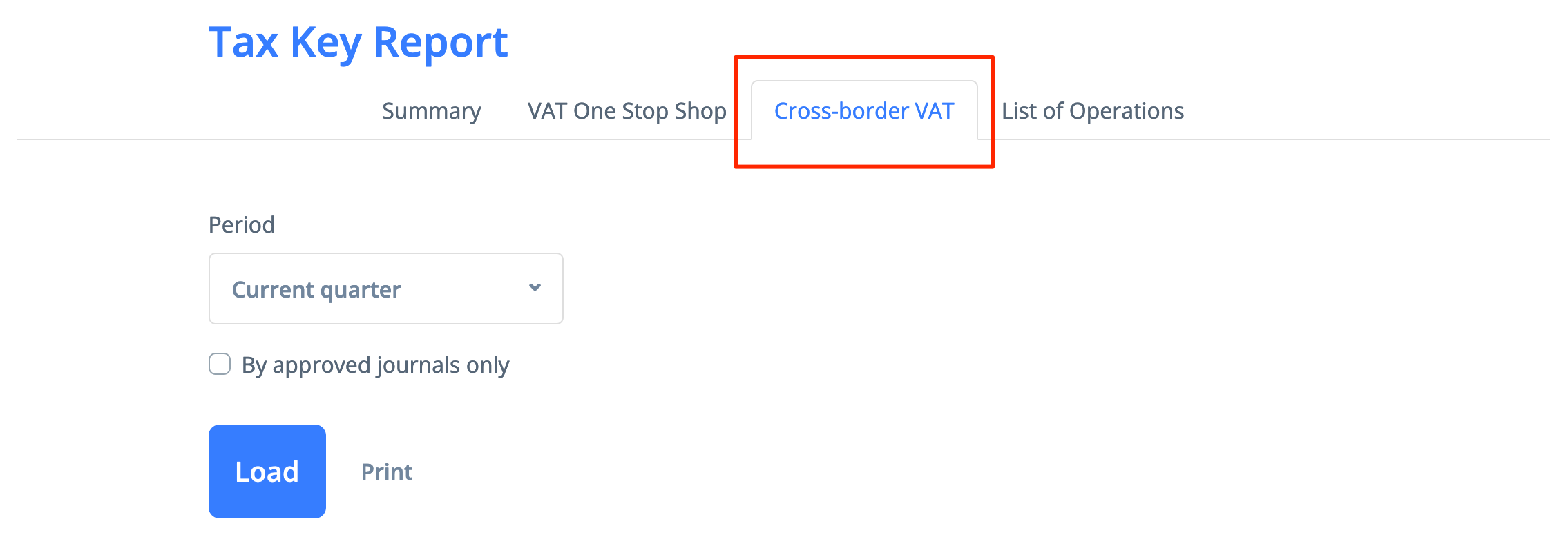

The transactions with such tax keys will be shown in the separate tab of the Tax Key Report