By default product cost calculation does not include any indirect (overhead) expenses such as customs duties, shipping, packaging, temporary storage and so on but only the direct cost of goods purchased.

Indirect expenses can be included into the product cost only if they are additionally linked with the invoice of goods purchased.

For instance:

1) You buy products from a Supplier A and receive a purchase Invoice A

2) Then you get a few more bills - B and C from Supplier B and Supplier C for some extra services that are connected with the initial purchase from Supplier A

3) You enter each of these documents individually as usual

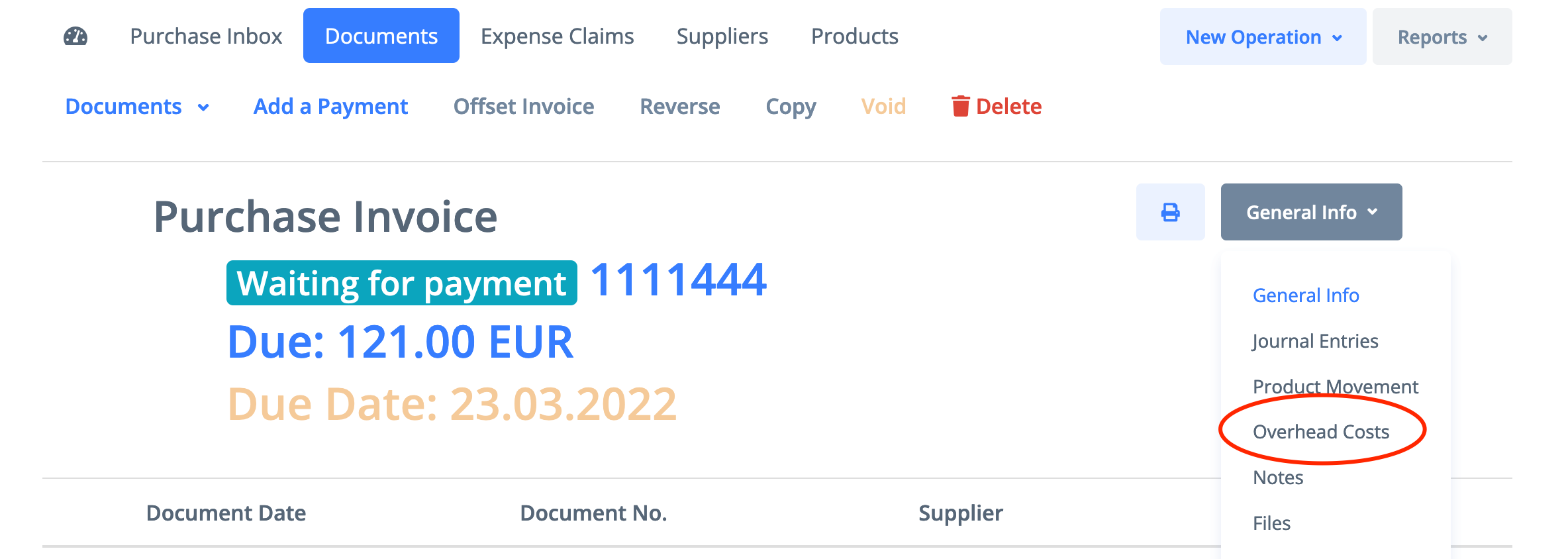

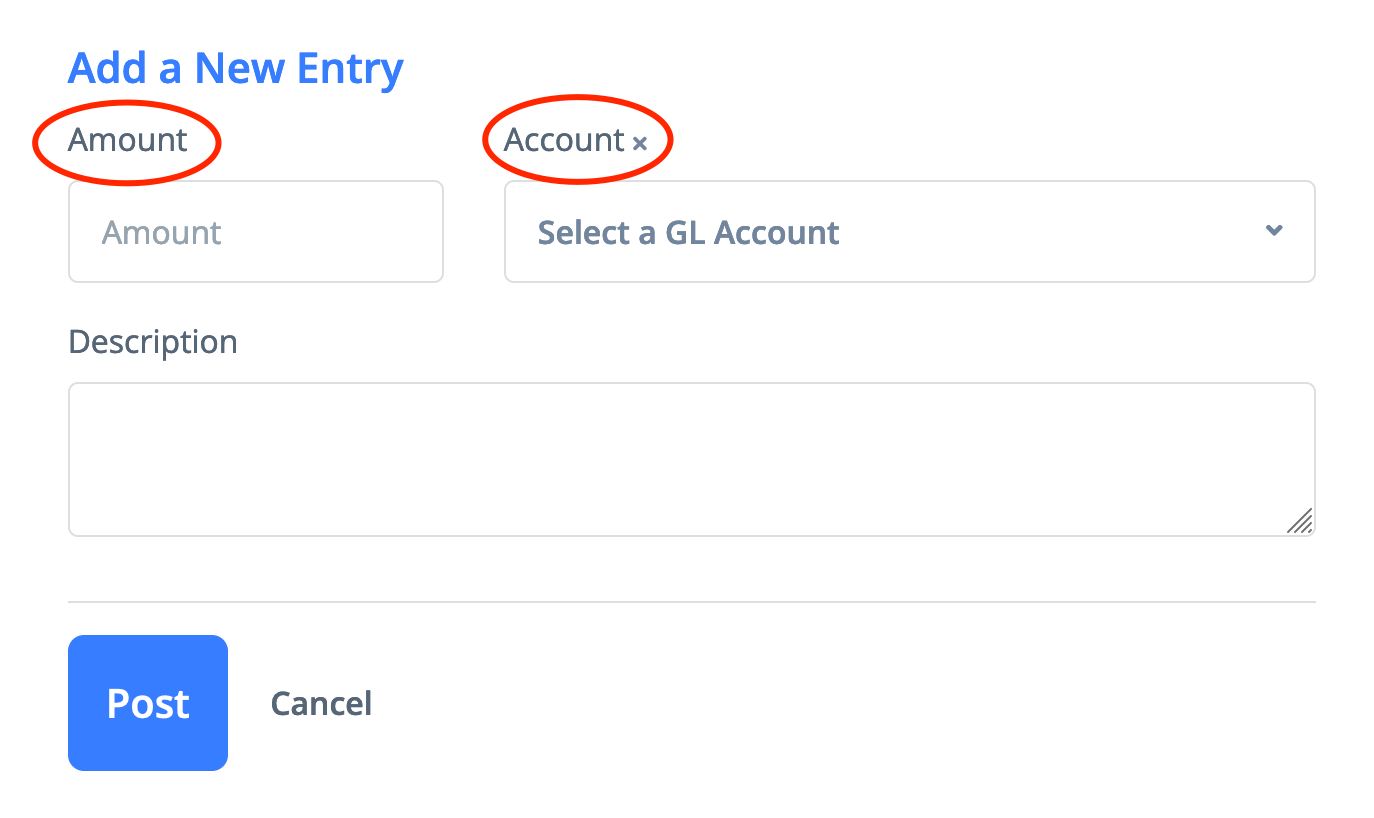

4) After that you open again the initial invoice A, go to the tab "Overhead Costs" and add one by one any extra expenses from invoices B and/or C by providing the expense account that has been used in these invoices and the exact amount you want to distribute among products from the invoice A.

That's all. The appropriate journal entries will be created and these extra expenses will be taken into account in the next product cost calculation and the cost of products from the invoice A will be updated.

This approach will give flexibility in selection what to include into the product cost and what don't as well as there is no difference which invoice will come first, for the extra services or for the products.