The two most common methods used for inventory valuation are FIFO and AVG (Weighted Average Cost method).

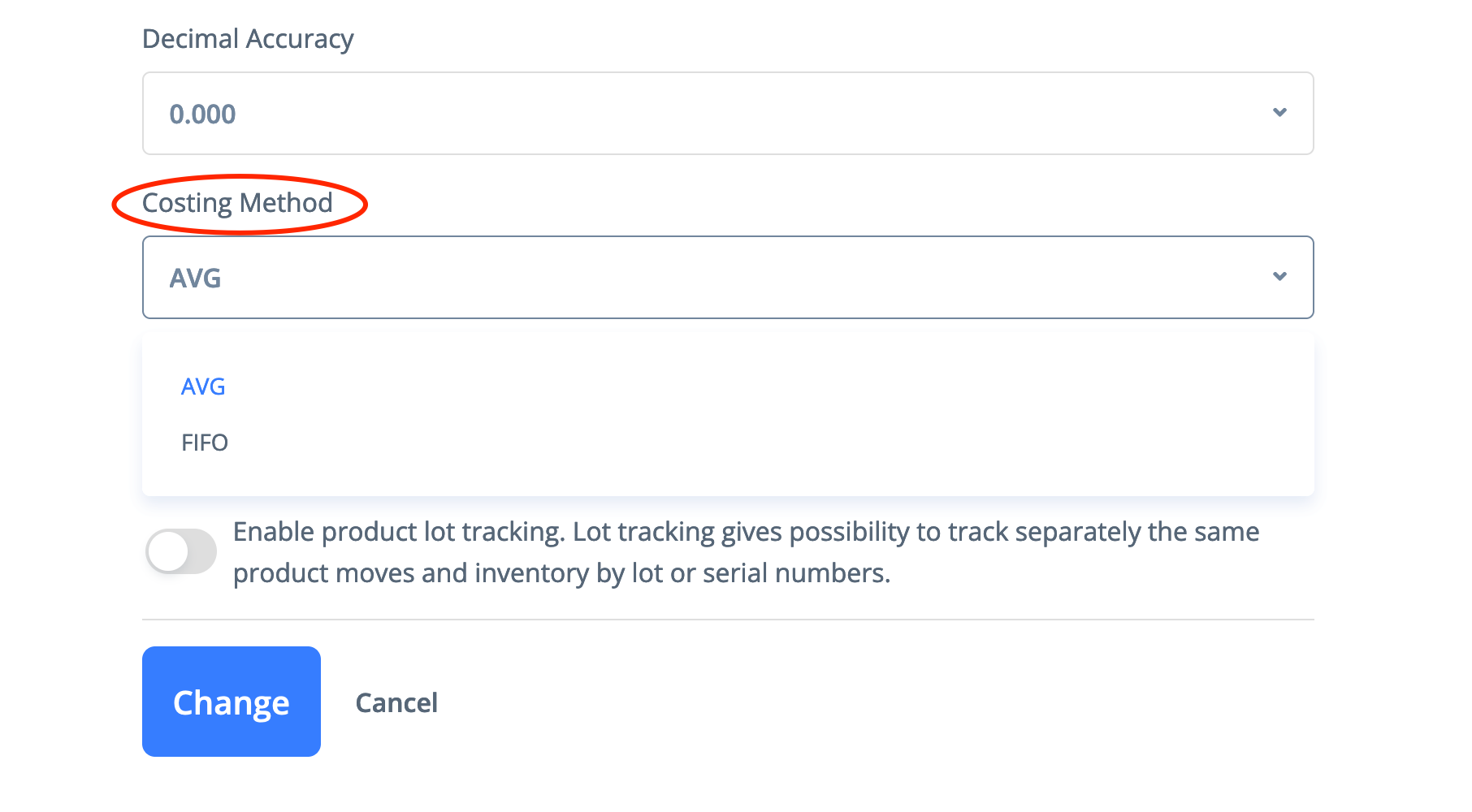

To change the inventory valuation method go to the Settings -> Company Profile -> General Info

FIFO

The FIFO method is based on the assumption that the goods are sold in the same chronological order in which they are bought, meaning the oldest items are the first to be sold. Thus, the inventory is valuated based on the latest purchase prices.

Due to the specifics of this method, the product’s cost price could be calculated only in case of non-zero stock of the product in the warehouse.

AVG

Under the Weighted Average Cost method, inventory is valuated based on the average cost of the goods available for sale. Average cost is calculated by dividing the total cost of the goods available for sale by the total number of the units available for sale.