Recurring journals are a repeating transaction which can be created based on any manual journal. Recurring journals are created by template automatically at certain intervals on a specified date.

They are typically done to record items like accruals and allocations. Recurring journals are very useful when you have prepaid transactions (such as an annual insurance payment) and you want to amortize the amount over the year so that your Profit & Loss Statement shows the correct accrued balance.

Companies often spend a significant amount of time tracking and posting these journal entries and preparing the appropriate account reconciliations to verify that they have been correctly recorded. Recurring journals automate this workflow.

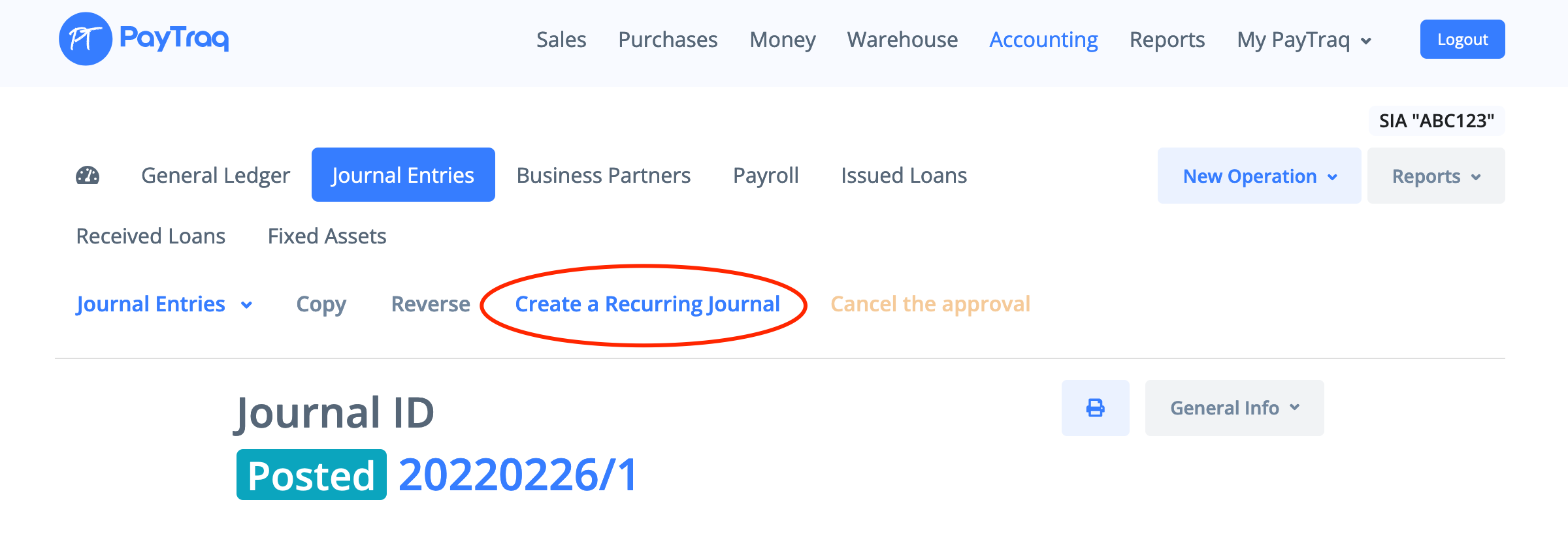

A recurring journal can be created from any manual journal.

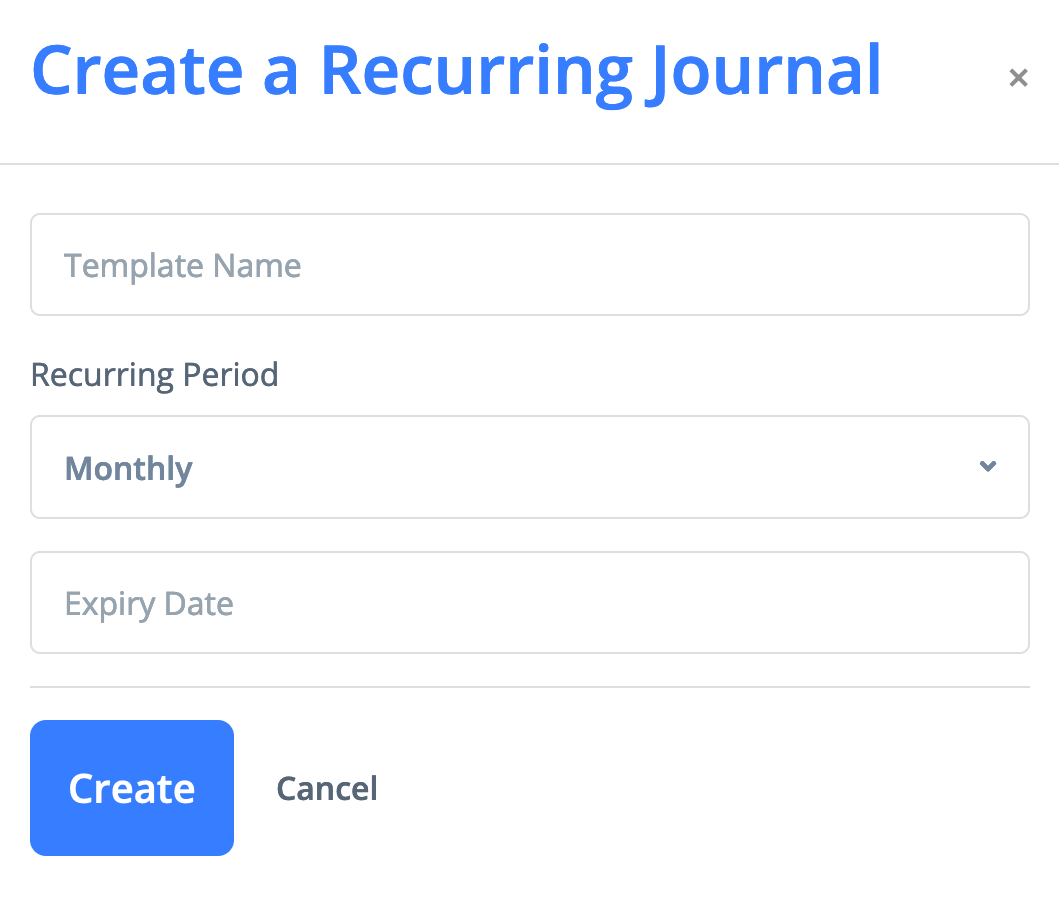

To do this click on ‘Creating a Recurring Journal’ button, enter template name, recurring period, and expiry date (optionally).

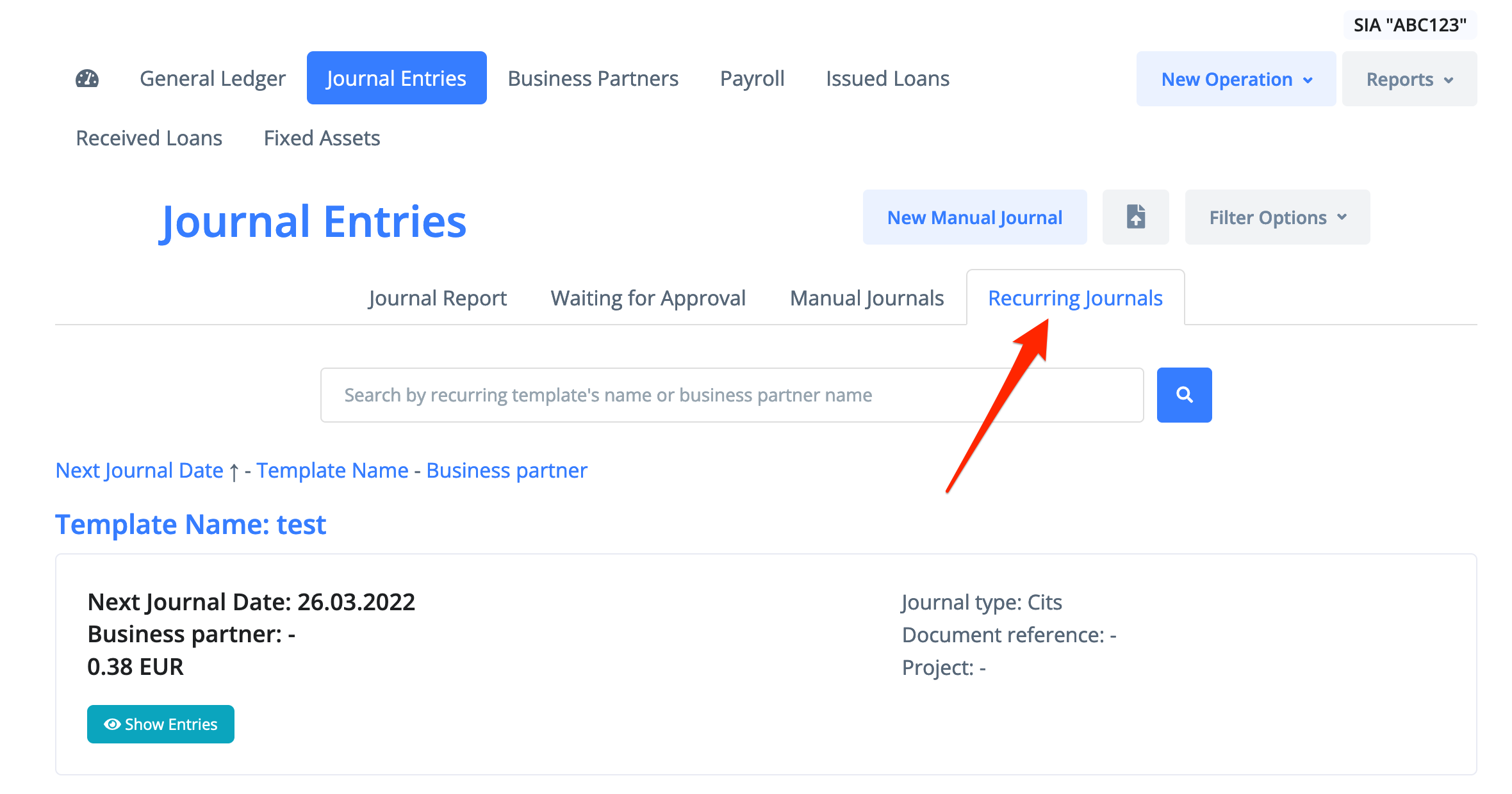

The journal template is available in the Accounting -> Journal Entries -> Recurring Journals tab.

Every recurring journal has a link to the initial journal. The recurring journal can be deleted by clicking Delete in the template. Also, the recurring journal template is deleted when the initial manual journal is deleted, voided, edited, or reversed.

The template’s expiry date indicates the date until when new journals are created automatically. Then, the template is deleted.

The date of the next journal is calculated as the journal date plus the recurring period (one week, month, quarter, year).

Note that the recurring journal only copies the initial manual journal based on the template specified. If a recurring journal is created from a manual journal with a foreign currency transaction, the newly created journal will use the exchange rate from the initial journal but not the current one.