This topic describes these two close concepts and contrasts different ways which are however used for.

Prepayment is when money has been paid upfront for something and against an issued document. Overpayment is when too much money has been paid.

Also to record prepayments and overpayments different general ledger accounts are applied.

Prepayments (or advance payments)

In case of sales, prepayment workflow is usually based on issuing a proforma invoice, receiving the money, issuing a final invoice and then offsetting the received prepayment.

After the entire transaction is complete, the status of the proforma invoice can be changed from Paid to Closed by clicking on the “Mark as Done” button.

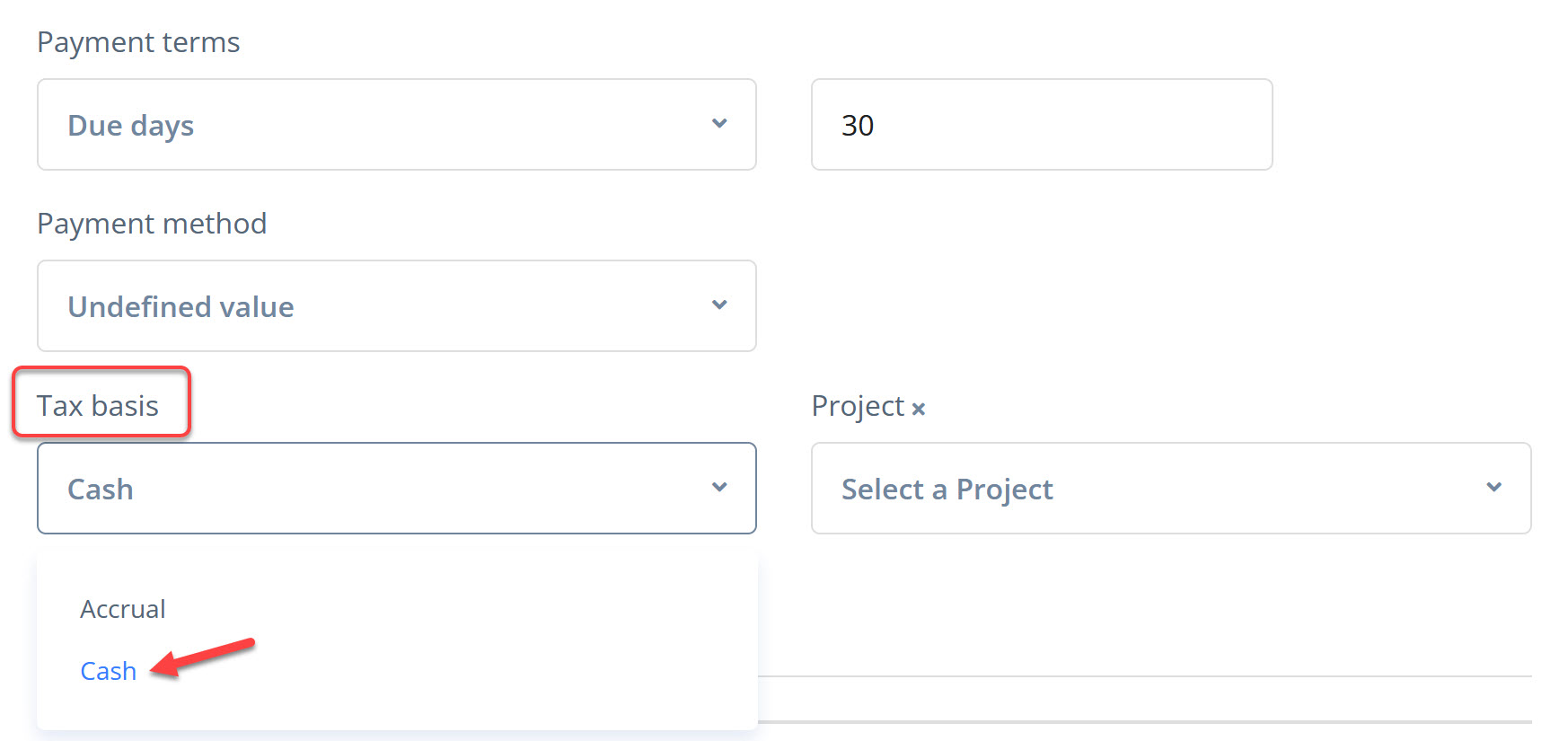

The automatic calculation and posting of VAT amount at the time of receipt of prepayments is supported by the program (in the case of the cash method was selected in the prepayment invoice).

Overpayments

Overpayments are usually revealed and recorded in the process of bank reconciliation. For example, when you receive money from a customer in case he has paid you more than he owes you in total. Thus, the received amount (or part of it) cannot be attributed to any document (proforma, outstanding invoice etc.).

In order to record the overpaid amount there is a corresponding button "Add as overpayment" in the payment form.

When issuing an invoice, an existing overpayment can be set off at the time of invoicing (checkbox "Use Overpayment") or afterwards as one of the payment options.

Both overpayments and prepayments are highlighted as separate lines in the Balance Confirmation with partner.

You may view list of all overpayments in the partner’s Statement by selecting an overpayment account.

All default accounts, including those for prepayments and overpayments, are available for viewing and editing under My Company -> Settings -> Accounting -> Default Accounts.