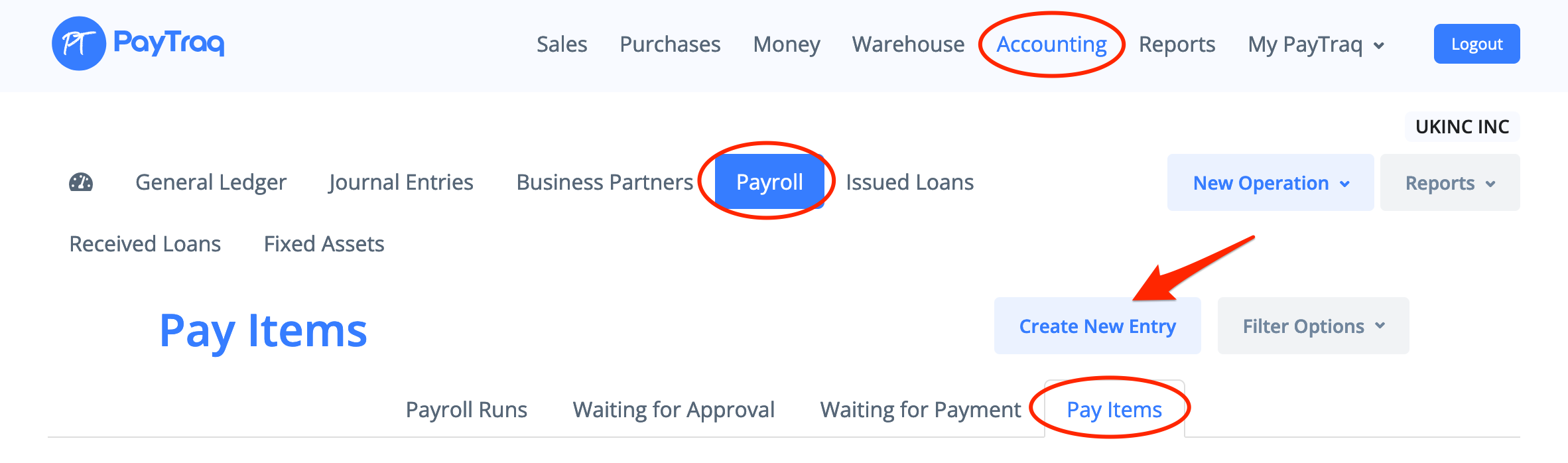

Pay items are positions based on which a payroll is run.

Pay items include the type, name, amount or formula of the payroll run and account.

The types include:

- Wages and Salaries

- Additional Payments

- Deductions

- Withholding Allowances

- Taxes

- Post Tax Deductions

- Employer Contributions and Duties

The total amount of payroll, bonuses and deductions-type pay items is gross income (the placeholder for the formula is G). The amount and General Ledger account for these pay items is available in the Settings.

Gross income less the benefits is taxable income (the placeholder for the formula is T). The amount or formula of the payroll run is available for the benefits in the Settings.

For Pay Items with type Taxes you can set a fixed amount or calculation formula and tax payable account.

Gross income less taxes is net income (the placeholder for the formula is N).

For Pay Items with type Post Tax Deductions the amount and employee payroll account are available in the Pay Items tab.

For Pay Items with type Employer Contributions and Duties a fixed amount or calculation formula are available as well as tax payable and expenses accounts.

Pay items which type is set by default will be added into the new pay run automatically.

Formulas in addition to placeholders can also contain conditions and variables. The syntax for writing a formula corresponds to the standard JavaScript syntax.

Example 1:

if(G<=1667) {T*0.20} else {T*0.20+(G-1667)*0.03}Example 2:

var x=380-0.5*(G-400);

if (x>0 && x<=380) {x} else {0};