When you acquire an asset using an invoice, expense claim, or manual journal, you allocate the purchase to a fixed asset account. You also have to create a fixed asset card where will be registered all the information about a fixed asset including its main characteristics, value, depreciation schedule, and accounting settings.

A fixed asset registration is a very flexible procedure in PayTraq as a fixed asset card are not tied directly to journal entries. Thus, you can either start with a fixed asset card creating and then register purchase invoice (and make the journal entries related to purchasing of a fixed asset) or you can create a fixed asset card afterwards.

To create a fixed asset card:

1. Go to Accounting > Fixed Assets click Create a New Fix Asset button.

2. Enter a fixed asset Purchase Date and select a fixed asset name from the product list or enter the name of the new fixed asset (the product will be added to the list of Fixed Asset-type products), and click Continue button.

3. Fill out the General Info tab by entering asset number (automatic numbering is available) and fixed asset gross value (cost of acquisition). In this tab you can also choose General Ledger accounts appropriate to a new fixed asset.

Note: It is essential that the new fixed asset gross value equaled the amount posted in the fixed asset account.

To approve the entered information click Approve/Post button. From now on, you cannot edit the General Info tab from the fixed asset card.

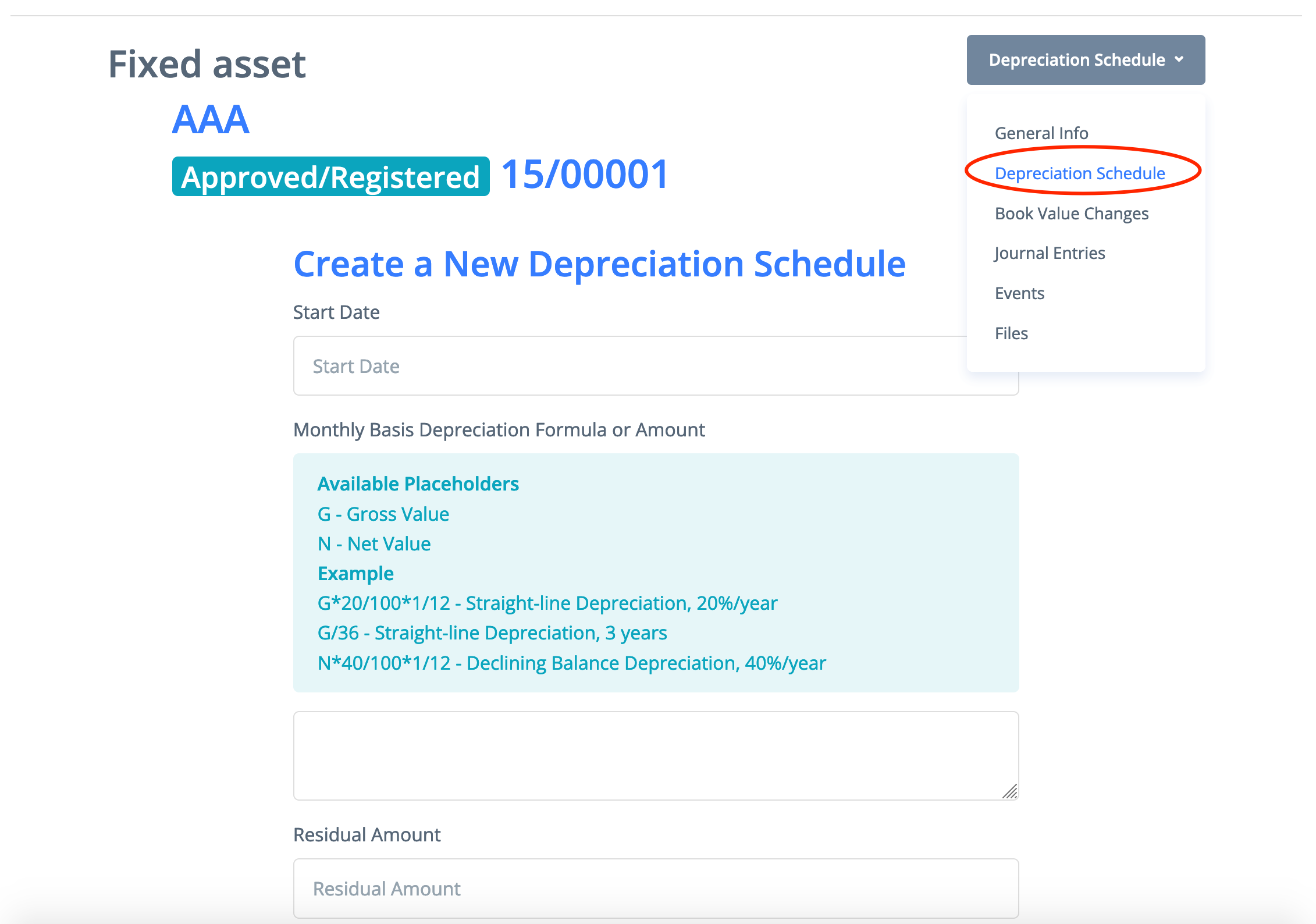

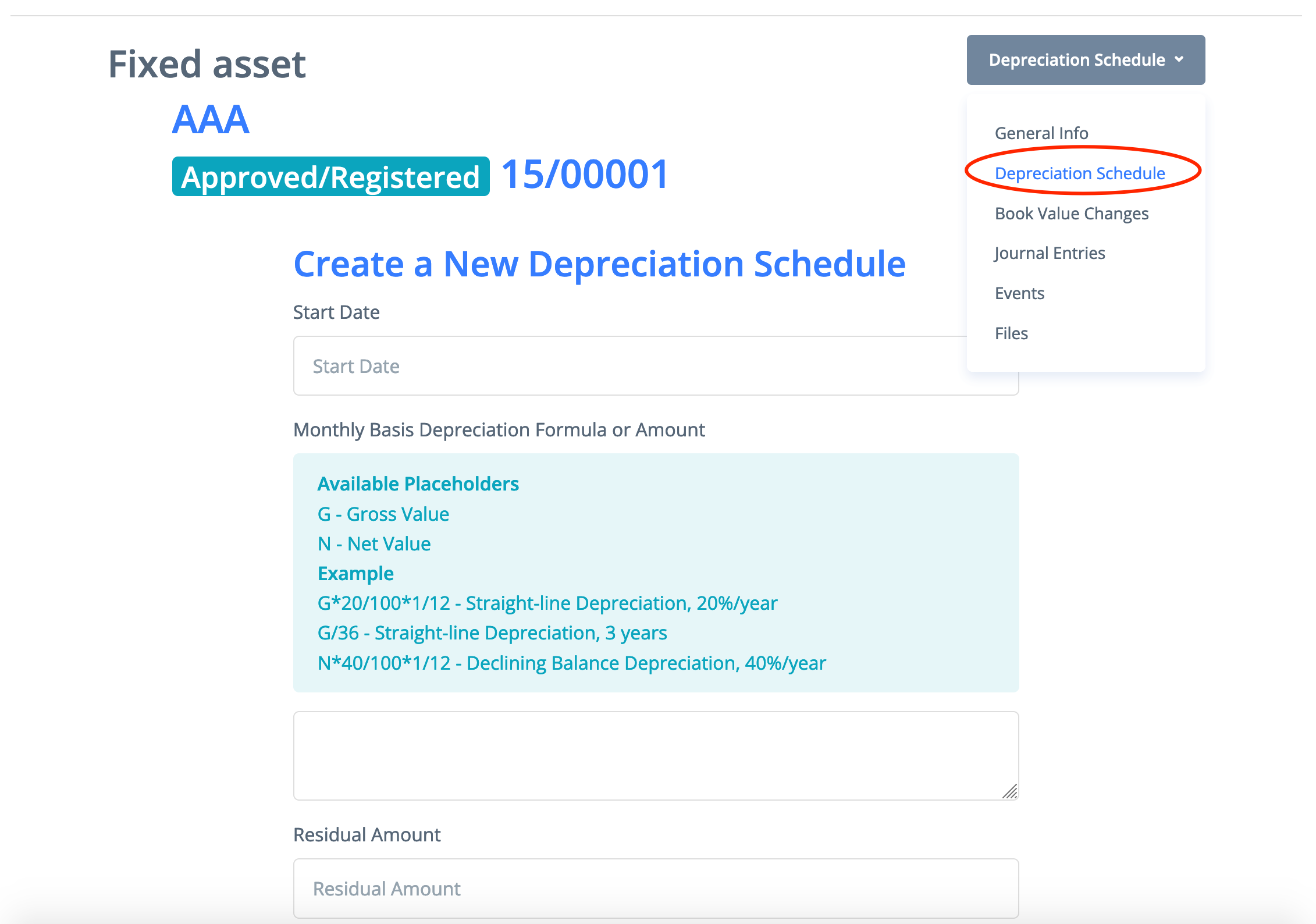

To add a depreciation schedule for new fixed asset, enter the date of the beginning of the period, for example, the first day of the next month, and formula with the placeholders available (G – Gross value, N –Net value). If needed, enter the residual amount. Residual amount is the threshold value up to which depreciation is calculated.

After that, you can view and check the depreciation schedule and approve it if everything is fine. All subsequent entries will be made automatically. All entries before the current date will be made the moment the depreciation schedule is approved. Also, you can zero out the schedule any time you want and create a new one.

To write-off a fixed asset, click Dispose/Sell and update the entry for writing-off a fixed asset. The entry will zero out the fixed asset and depreciation account and change the status of the fixed asset card into Disposed/Sold.

To change the value of a fixed asset, click Adjust/Revalue and update the entry for adjusting the value of a fixed asset. Note that changing the value of a fixed asset automatically zeroes out the depreciation schedule, and a new depreciation schedule will need to be created.