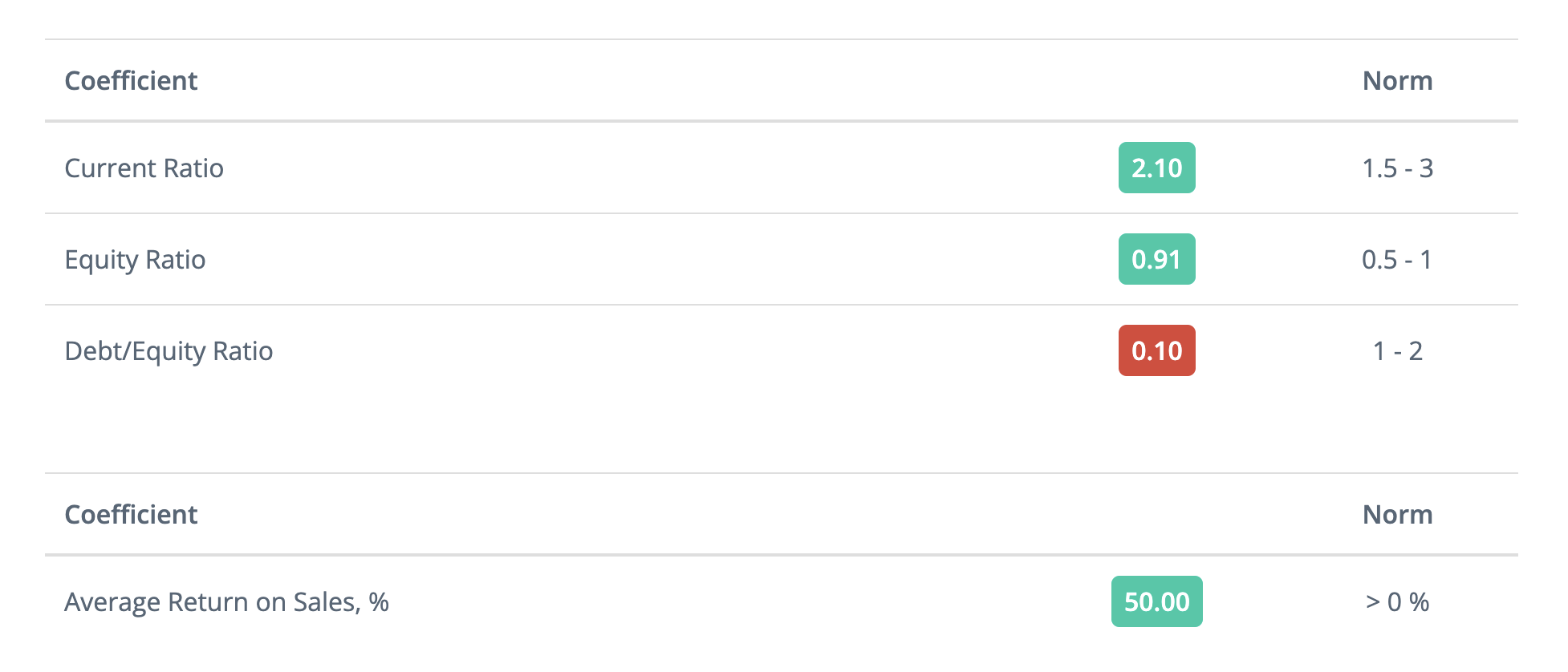

There are four indicators for the financial analysis with their normal values in PayTraq at the main dashboards.

Current Ratio (or Liquidity Ratio)

To calculate it, we need to take the current assets from the balance and current liabilities. Current assets are funds of an enterprise that generate revenues one or more times during the year. These include stocks, debtors and cash. Current liabilities are a borrowed capital, which must be repaid within a year.

The ratio of the current assets to the current liabilities is the Current Ratio. This ratio indicates whether the enterprise has sufficient assets that can be used to repay short-term obligations. In practice, the value of the indicator should be in the range from 1.5 to 3. If the index does not reach the lower limit, then the company has no assets to pay off short-term lenders and is liable to bankruptcy. Exceeding the upper limit indicates the irrational structure of assets; in other words, the current assets do not work and remain useless.

Equity Ratio

The equity ratio is an investment leverage that measures the amount of assets that are financed by owners' investments by comparing the total equity in the company to the total assets. To calculate it, we need to take the equity capital, which consists of share capital and retained profit from the balance and divide it by assets. The indicator shows the share of assets formed out of their own capital.

The lower the figure, the greater the property was purchased at the expense of the borrowed capital, the higher the dependence on creditors and the less financially secure. The recommended value of the indicator should be in the range from 0.5 to 1.

Debt-to-Equity Ratio (or Financial Leverage)

To calculate it, we need to take all the borrowed capital of long-term and short-term creditors from the balance sheet and divide it by the equity. This indicator measures the degree to which the assets of the business are financed by the debts and the shareholders' equity of a business; in other words, how much profit the enterprise has received by attracting debt capital.

If the value of the indicator is great, then the enterprise loses its financial independence, and it is more difficult for them to raise additional borrowed capital. If the value of the indicator is low, then there is lost opportunity to use financial leverage – to increase the return on equity at the expense of the borrowed funds involvement in the activities. The optimum value of the indicator is from 1 to 2.

Average Return on Sales

To calculate this ratio we need two numbers from profit and loss statement, take the operating margin from sales (operating profit) and divide it by turnover (sales). The indicator tells us how much operating profit we get from one sale. For enterprises operating at a profit rate, the indicator must be greater than zero.