CSV Bulk Invoice Import can be used for automatic uploading and processing of the list of sales documents from CSV file.

It is possible to select the document type and the operation type before starting the process.

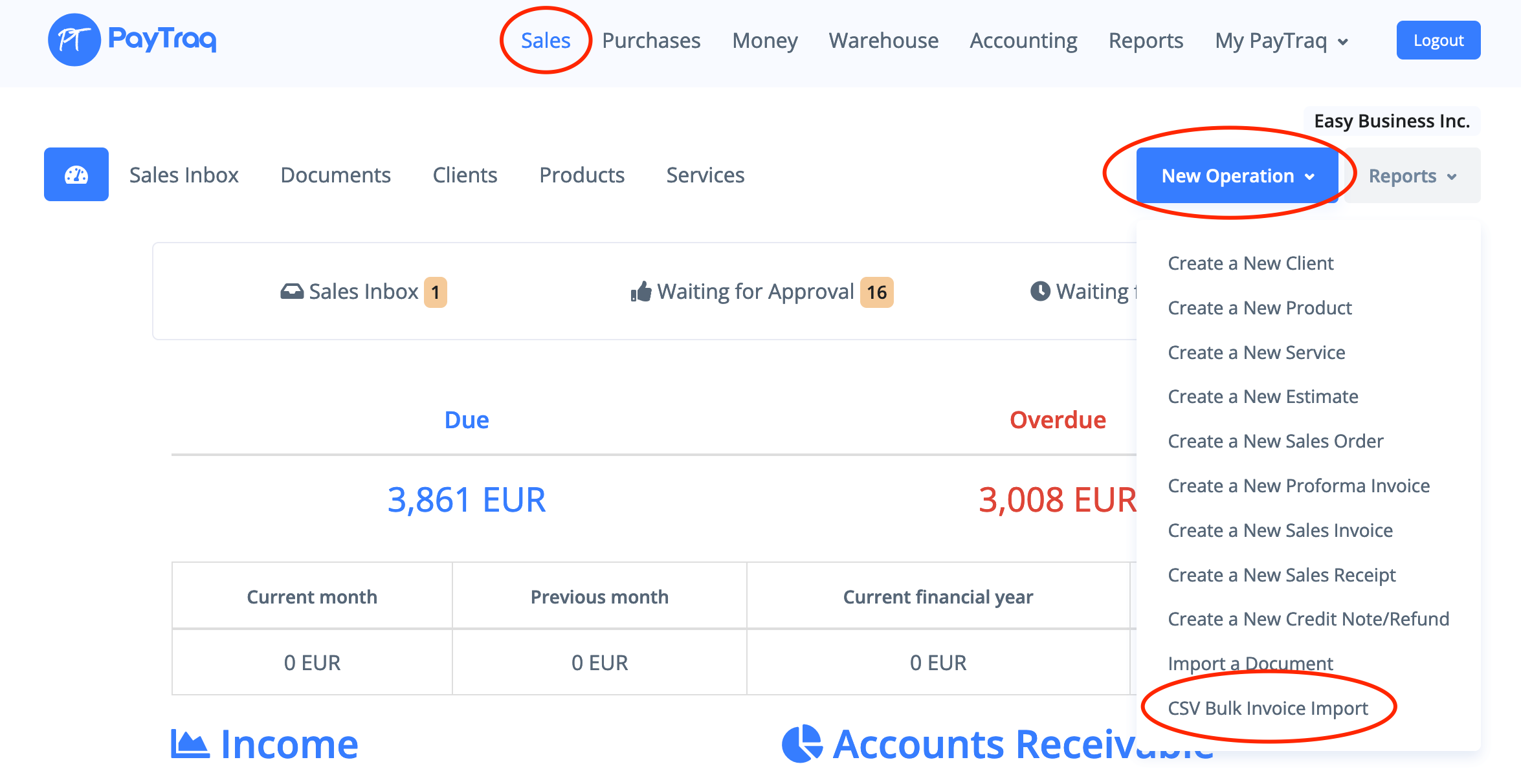

CSV Bulk Invoice Import is available by going to Sales -> New Operation -> CSV Bulk Invoice Import.

Each of the processed documents can be either saved as draft or posted or send by email.

Import runs in the background mode so it's not required to wait while the process will be completed by staying on the same page.

Required fields (columns):

- InvoiceDate - document date, if it is left blank the current date will be used

- ClientName - client name, if client is not found it will be created

- ItemName1 - existed product/service name or item description

- ItemPrice1 - price, if it is left blank the price from the price list will be used (for existed product or service)

All other fields (columns) are optional.

The columns order does not matter but the headers are important and should be the same as in the template.

The required columns are marked with asterisk in the template but this symbol is not required.

The fields to add a line item (N - increment number):

- ItemNameN - existed product/service name or item description;

- ItemCodeN - existed product/service code, if item name is left blank then the item will be looked up by the given code;

- ItemDescriptionN - line item description;

- ItemQtyN - quantity, if it is left blank then the value 1 will be used;

- ItemPriceN - price, if it is left blank the price from the price list will be used (for existed product or service);

- ItemDiscountN - line discount in %;

- ItemAccountCodeN - account code, if it is left blank the default code will be used;

- ItemTaxKeyN - tax key name or ID, if it is left blank the default tax key will be used;

Up to 25 line items are supported for a document row: ItemName1, ItemName2, ItemName3, ... ItemName25

At least 2 columns should be added for every additional line item (N - increment number):

- ItemNameN

- ItemPriceN

InvoiceNumber - document number, if it is left blank the auto generated number will be used;

The fields to create a new client:

- ClientName - client name

- IsCompany - client type, the value should be 1 or true to set the type to Corporate

- ClientRegNumber - registration number

- ClientVatNumber - VAT number

- ClientAddress - address (street, city)

- ClientZip - zip code

- ClientCountry - 2-Letter country code (ISO 3166-1 alpha-2)

- ClientEmail - email address

The existed shipping address will be looked up by the following fields:

- ShippingTo

- ShippingAddress

The fields to create a new shipping address:

- ShippingTo - recipient name

- ShippingAddress - address (street, city)

- ShippingZip - zip code

- ShippingCountry - 2-Letter country code (ISO 3166-1 alpha-2)

- ShipperName - shipper name

The fields to add a shipping charge:

- ShippingCharge - shipping charge;

- ShippingChargeAccountCode - account code, if it is left blank the default code will be used;

- ShippingChargeTaxKey - tax key name or ID, if it is left blank the default tax key will be used;

PaymentMethod - payment method, can contain one of the following values (If it is left blank the default value will be used):

- 0 - Not Defined

- 1 - Bank

- 2 - Cash

- 3 - Card

- 4 - Prepayment

- 5 - Offsetting

- 6 - Factoring

The fields to add a billing period (If both fields are missed or left blank the period will not be set):

- PeriodFrom - start date;

- PeriodTill - end date;

Comment - comment;

The fields to add a new payment to the posted document (N - increment number):

- MoneyAccountNameN - money account name, the currency of the account should be the same as in the document;

- PaymentAmountN - payment amount;

Up to 3 payment types are supported for a document row: MoneyAccountName1, MoneyAccountName2, MoneyAccountName3