Most people know debit and credit outside the context of bookkeeping.

Bank cards, for instance, are commonly used almost by everyone. There are debit and credit payment cards. The former allows us to spend money directly from our current account; credit cards, on the other hand, offer an opportunity to use a bank credit line, thus giving a free hand to spend borrowed money. Debit in this context is the money received from the bank account, and credit is the money available on a bank loan.

Debit and credit are also commonly known through the bank statement where the write-off amounts are specified in the debit column, and the charged amounts are indicated in the credit one.

Nevertheless, bookkeeping double entry implies a different role and idea of debit and credit.

For you to use debit and credit to trace economic operations under various types of business accounting records, you should know how to see the difference between them. Here you can read in detail about an account in accounting records and the types of accounts.

In terms of bookkeeping, debit means an increase of any asset (money, materials, and capital assets) and a decrease of liabilities (loan obligations, retained profits, and legal capital), while credit means the very opposite. Just like this, these are not just about the income and expenditure of a company.

Debit and Credit in Double Entry

Any business operation is recorded in bookkeeping as debit and credit amounts using a so-called T-account (accounting entry) format. According to this approach, debit is recorded on the left of the ‘T’, and credit on the right. (Therefore such kind of entry is called double). Each record made in a general ledger requires both debit and credit entries.

A source account (account where the money for a transaction is coming from) is generally credited on the right, and an allocation account (account where the transaction money finally arrives at) is debited on the left.

To be valid, an entry should be balanced; i.e. the total debit amount shall be equal to the total credit amount. Sometimes, to equal both sides, one T-account may have several debit and credit entries.

Let’s take a look at some examples

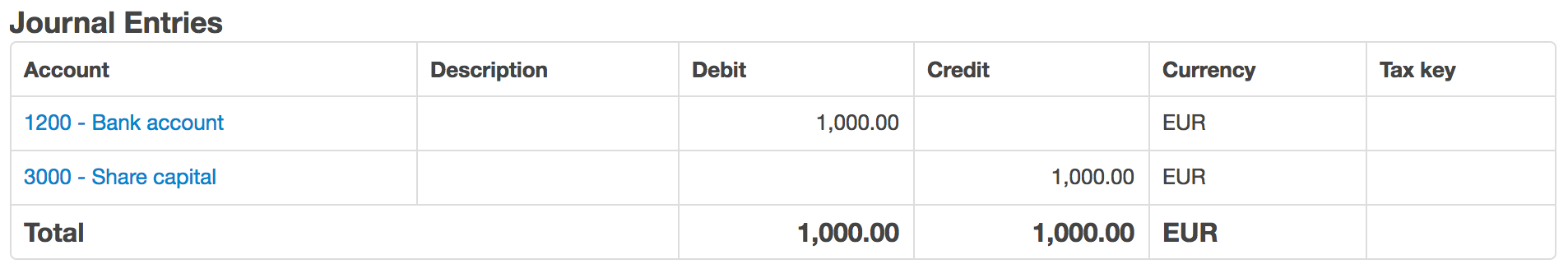

Example 1: You, as a business owner, decide to invest EUR 1,000 in your business. In this case, the assets account will be the source account. Once the source account is recorded on the right of the T-entry, 1,000 EUR will be credited to the assets account. The allocation account will be the bank account in this example; so, to balance the entry, these EUR 1,000 will be added to the left, i.e. debited to the bank account.

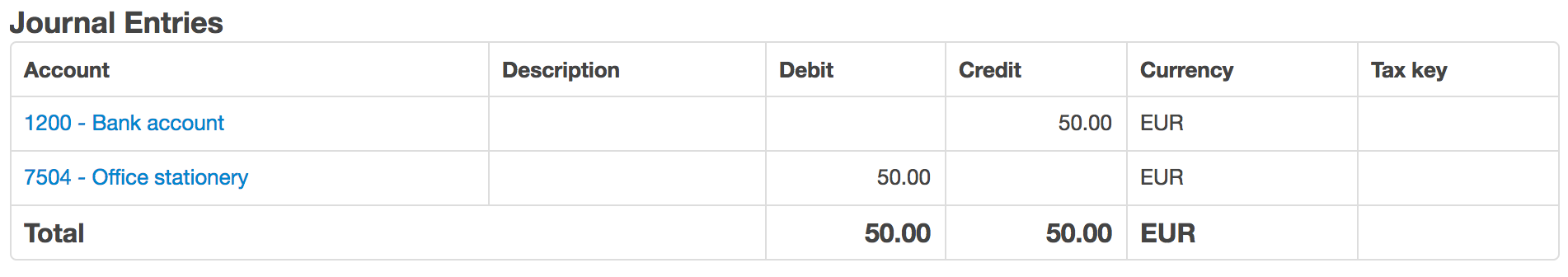

Example 2: Following Example 1, now you purchase some office supplies for a total amount of EUR 50 from your bank account. In this case, the source account will be the bank account, so EUR 50 will be credited to the right of the T-entry. The account of the expenses for the office supplies in its turn will be the allocation account, which will be debited and added to the left.

Debit and Credit Balance

Account balance indicates the difference between the debit and credit amounts of all operations of this account.

If total debits (debit turnover) exceed total credits (credit turnover), this debit excess is called debit balance (such amount is always positive). Otherwise it’s called credit balance (such amount is always negative).

The trial balance shall state that the total of all debits equals the total of all credits. If they are not equal, it means that there are errors in the records – unbalanced journal entries in the accounting system.

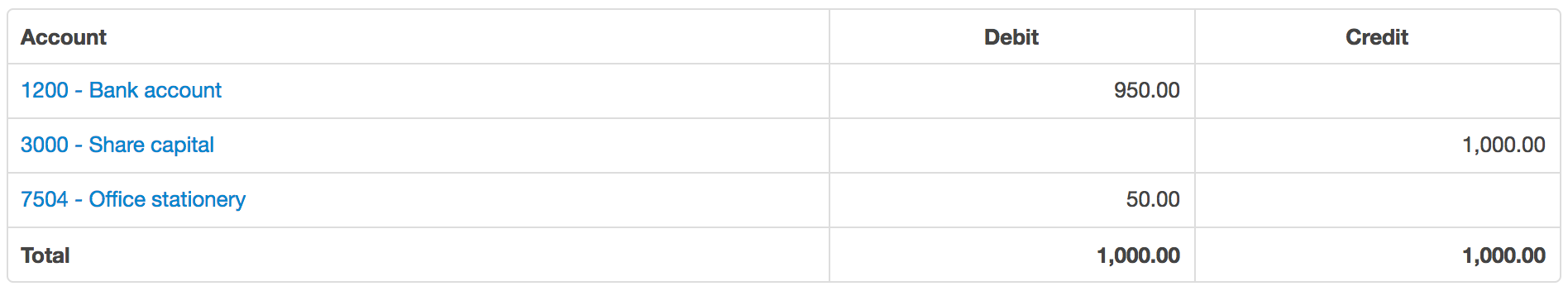

Now let’s present the entries of the above mentioned examples as a general ledger, in other words, let’s represent the turnovers on each side of the T-entry for each account:

And as a trial balance: